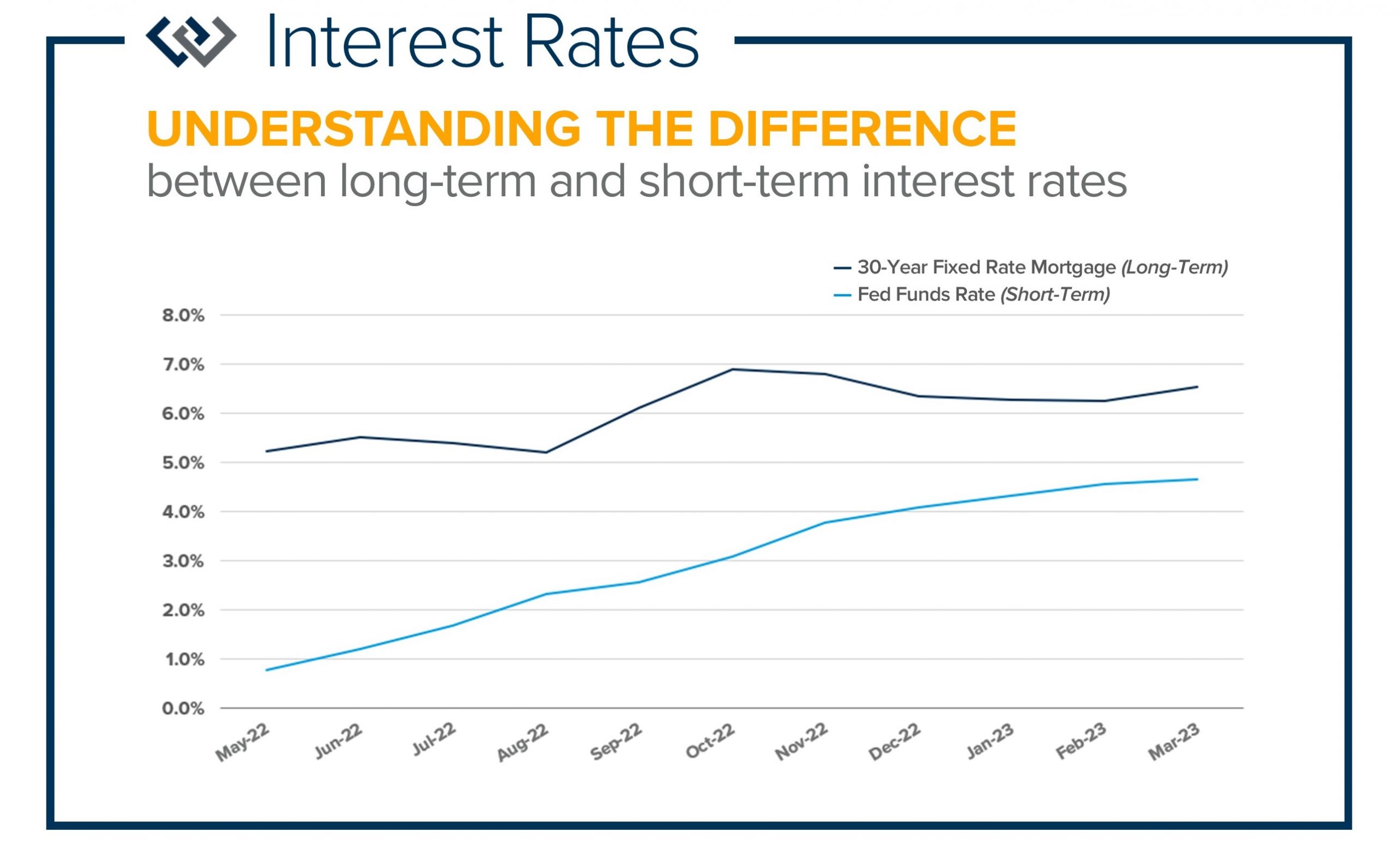

It is very important that consumers understand the difference between long-term interest rates and short-term interest rates. Long-term rates involve home mortgages such a conventional 30-year fixed, Jumbo, FHA, and VA loans. Short-term rates involve car loans, credit cards, and Home Equity Lines of Credit (HELOCs). While both types of rates have gone up over the course of the last year, they have not had the same trajectory.

It is very important that consumers understand the difference between long-term interest rates and short-term interest rates. Long-term rates involve home mortgages such a conventional 30-year fixed, Jumbo, FHA, and VA loans. Short-term rates involve car loans, credit cards, and Home Equity Lines of Credit (HELOCs). While both types of rates have gone up over the course of the last year, they have not had the same trajectory.

In an effort to combat inflation and slow spending, the Fed has made consistent increases to the short-term rate over the last year. I am sure you are running out of fingers on your hands to count the number of times you have heard this as a top story on the news: “The Fed Raises Rates!”. A huge misconception has been that the rates the Fed are referring to are mortgage rates.

As you can see from the chart above, the short-term rate has had a consistent upward trend and the long-term rate has had a more volatile journey. In some cases, when the Fed has increased the short-term rate, the long-term rate has gone down! My point in all of this is to illustrate that what the media reports is not always about mortgage rates and that it is important to stay connected to accurate data.

Matthew Gardner, Windermere’s Chief Economist recently recorded a video update featured below that speaks to some of the misconceptions about interest rates, specifically mortgage rates. Many consumers are confused and misinformed which is dangerous. Investing in real estate is the single largest wealth-building opportunity and to not be accurately connected to the latest trends could get in the way of a successful financial picture.

Prices in many markets have already bottomed out from the 2022 correction and mortgage rates have come down off the peak. In some areas, we are already seeing appreciation again! This quote from Matthew sums up where we are headed. “Myself, and every economist I know, believe that rates will slowly pull back as we move through 2023, and I haven’t seen a single forecast suggesting that mortgage rates will rise to a level this country hasn’t seen in decades”.

With inflation slowing and year-over-year CPI (Consumer Price Index) numbers becoming less extreme, mortgage rates will start to soften. In fact, there are some important reports coming up in May that will tell this story. Real estate is a long-term hold investment that has been the cornerstone of wealth in our country. The wave we have had to ride post-pandemic related to supply chain issues and consumer demand is coming to the shore and real estate will remain an investment safe haven.

Another point to consider is while real estate is an investment is it also where you live. Life changes, good or bad, lead to moves. All this to say, remain nimble by being well-informed. Knowledge empowers strong decisions and accuracy matters. You can count on me to provide you with the information you need to successfully navigate your real estate decisions. Please reach out if you’d like to discuss how the current trends relate to your goals.

Shred Day & Food Drive was a huge success!

Big thank you to everyone who came by to utilize our free shredding services and drop off food or cash donations for the Volunteers of America Western Washington food banks!

We filled two trucks of shredding and collected over 2,000 pounds of food and $3,372 which will go to our neighbors in need. Thank you for your generosity!

ATTENTION GARDENERS: Windermere Community Service Day is coming and we’d love your help!

ATTENTION GARDENERS: Windermere Community Service Day is coming and we’d love your help!

Since 1984, Windermere associates have dedicated a day of work to complete neighborhood improvement projects as part of Windermere’s Community Service Day. After all, real estate is rooted in our communities. And an investment in our neighborhoods gives us all a better place to call home.

Our office will spend the day with the Snohomish Garden Club working to put fresh produce on the tables of local families who need a little help. We will plant over a half-acre of veggies and fruits that will be harvested over the summer and into the fall.

If you’d like to pitch in, we are looking for additional veggie starts. Let me know if you have some starts already going or if you would like to prepare some now that you would be willing to donate. Our planting day is Friday, June 9th; I can arrange the details with you for drop off or pick up!

The garden specifically needs:

- Scallions

- Snow/Pod Peas (please no shelling peas)

- Chard

- Lettuce (the food banks require headed varieties, rather than loose-leaf)

- Squash (any kind, EXCEPT yellow crookneck)

- Cabbage/Broccoli/Kohlrabi/Cauliflower/Collards/Kale

- Peppers (early maturing varieties work great: ~70-day range)

- Herbs (never enough Basil and Parsley!)

- Flowers (marigolds, nasturtiums, or any annuals)

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link