As your trusted real estate advisors, our service to you is beyond the transaction of buying and selling real estate. Your home is your nest egg and often your most significant financial investment, requiring care and attention to maintain and protect it. An important aspect of protecting your home is your Homeowners Insurance Policy. In the wake of several natural disasters over the past five years, insurance carriers have depleted their reserves and had to recalibrate their risk management plans. Carriers have mitigated their risk by analyzing which areas of the country have the highest likelihood of claims, as well as which consumers have the highest claim rates.

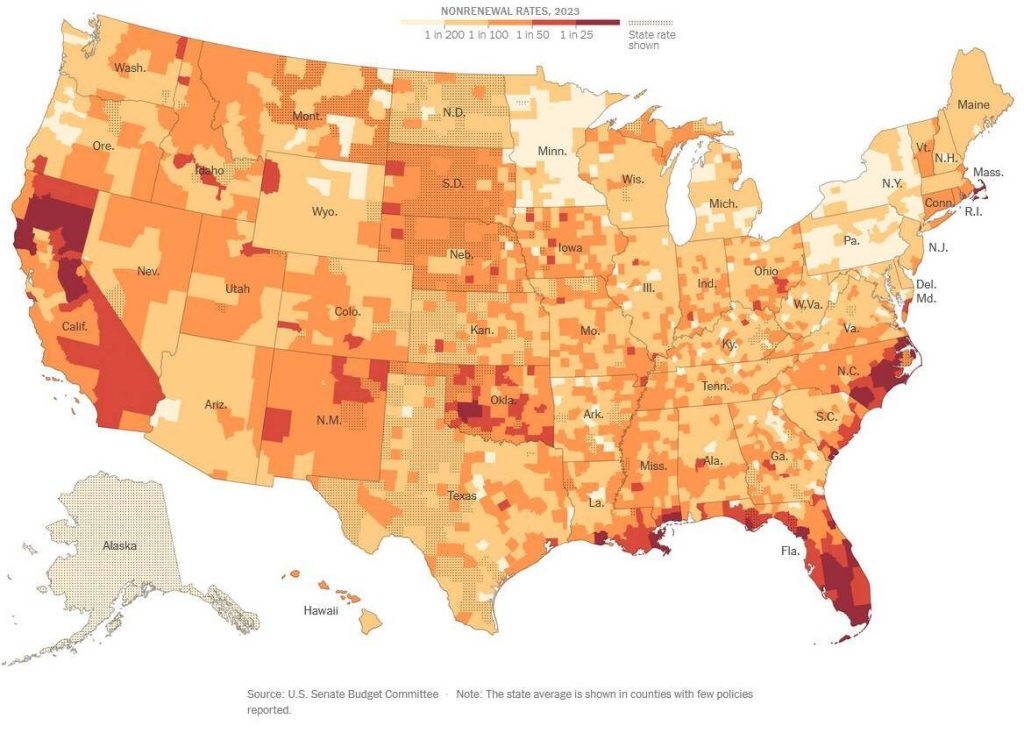

The heat map below illustrates the rate of cancelled policies nationwide based on risk, weather patterns, and claims history. Beyond available coverage, it’s essential to understand the scope of your policy and the riders that accompany it. That is why it is essential to have an annual review with your insurance provider, ensuring you are adequately covered and updating your Replacement Cost Value (RCV) as needed.

Furthermore, some carriers are revising their policies, including the states in which they will operate and the products and materials they will insure. For example, in 2025 Safeco/Liberty Mutual will stop writing new policies for condominium, renters, and watercraft insurance in the state of California. This month, they are also capping umbrella limits to $1 million in some states, forcing renewals to lower that level if they had a higher coverage amount. No company is immune to these effects, so it is important to explore your options for the most complete coverage. It is also essential to review all mail from your insurance providers as renewals approach, so you don’t miss any significant changes.

Although we are not insurance professionals, we have connections to some credible insurance professionals who can help you better understand the changing climate. Join us on May 7th for a live webinar featuring a panel of experienced insurance professionals who will share their insights and expertise on today’s rapidly evolving homeowners insurance market.

Windermere North is proud to host this educational webinar, featuring Peter Hong of Allstate Insurance, Alex Busilacchi of Moreland Insurance, and Douglas Olsen of USI Insurance Services.

The first hour will be a guided conversation covering key points and will provide information to shed light on how the volatile environment affects you and the protection of your home. Then we will open up for a live Q&A so you can get your questions answered.

Click the link below to register and receive the Zoom link, or reach out and we can send the registration link to your email. Registration closes May 4th.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link