While we are seeing the market show signs of improvement and uptick in activity in Q4 2025, the biggest challenge we see in the real estate market is affordability. Prices in our area have remained stable after many years of appreciation, and interest rates, while improving, are hovering around 6.25%. This combination has monthly payments expensive, especially for first-time buyers and buyers on fixed incomes, such as retirees, seniors, or people looking to retire and fix their overhead.

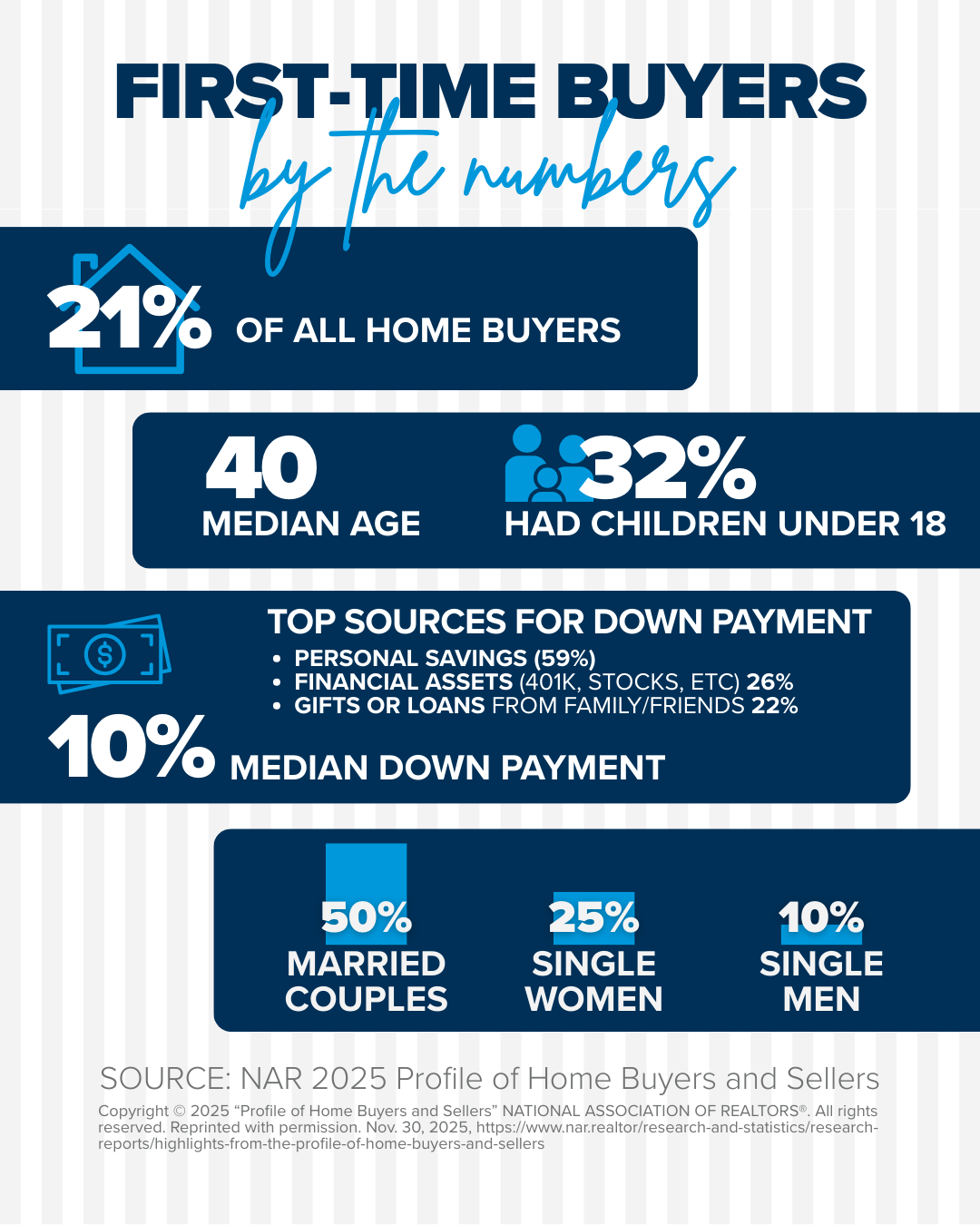

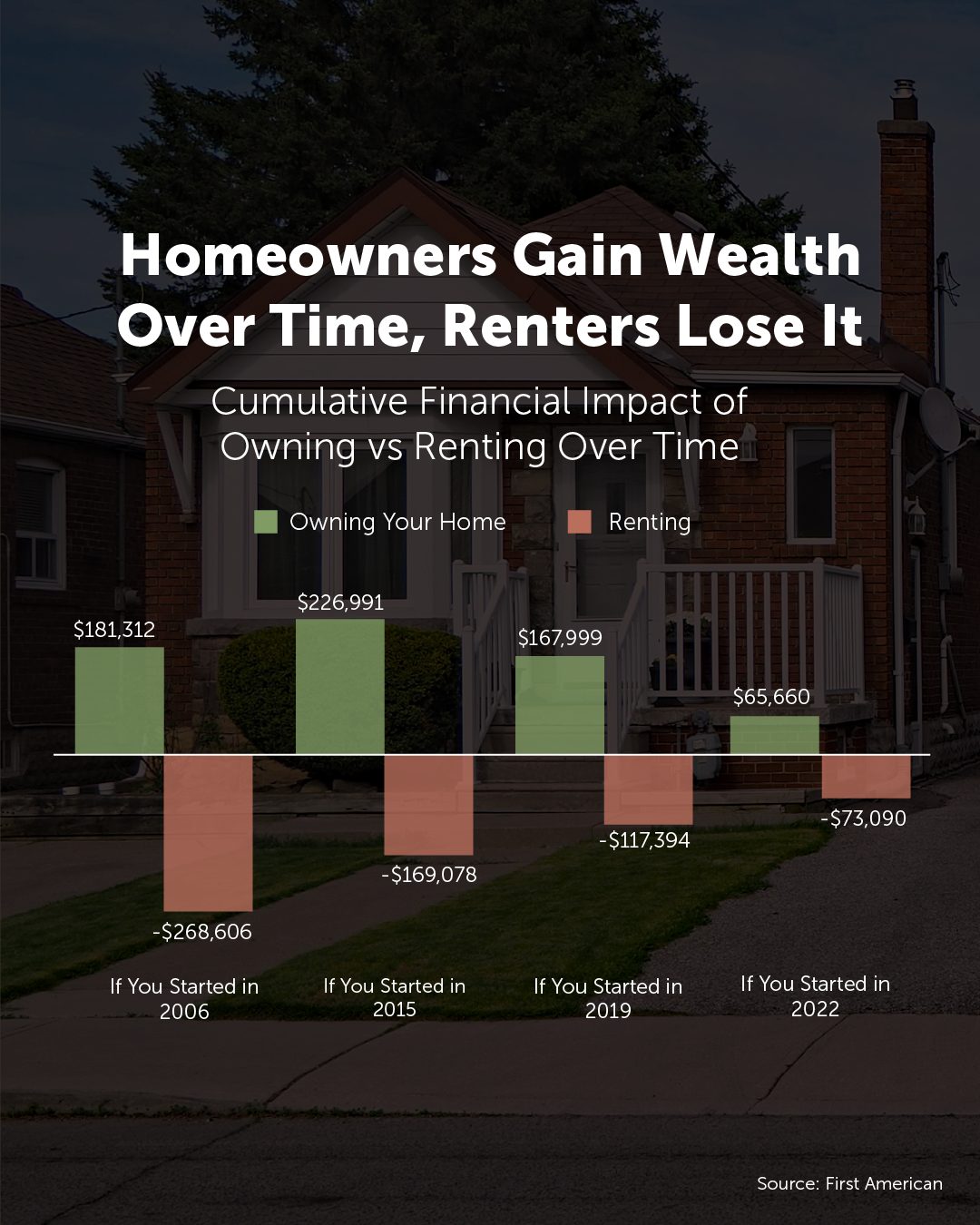

In fact, the latest Profile of Homes Buyers and Sellers by the National Association of Realtor (NAR) shows that the rate of first-time buyers is at an all-time low, accounting for only 21% of all buyers. The median age for this group increased to age 40, the highest ever. This illustrates that affordability is putting pressure on this group and delaying their start to building long-term household wealth. The average net worth of a renter versus a homeowner is staggering, so this is an important obstacle to overcome for those who have the resources but find themselves on the bubble of this decision.

We have helped buyers overcome affordability challenges by applying some creative house hacking strategies. These are powerful tools, as they can empower a person to become a homeowner instead of renting, putting them on the path to building household wealth much faster. Plus, Greater Seattle Area rents are costly, so if one can find a way to pay their own mortgage instead of their landlord’s, they will start to build a nest egg of security for their own future.

A common myth we see is that buyers think they need 20% down to buy a home. That is simply not true, according to NAR, the average down payment for a first-time buyer was 10%. While a 20% down payment can eliminate mortgage insurance, there are loan programs such as FHA and some Conventional programs that only require 3-5% down. There are also down payment assistance programs that are available that result in 0% down, and VA financing can be as low as 0% as well.

Speaking of down payments, we see buyers diversify by utilizing or borrowing against stocks and/or 401K funds, and the NAR survey revealed 26% of first-time buyers used these types of funds to achieve their homeownership goals. It is also not uncommon for some fortunate buyers to receive gift funds in order to achieve homeownership, and the NAR survey showed 22% of first-time buyers were able to utilize this route. With the big picture of building household wealth in mind and the fact that everyone needs a roof over their head, having your home be a part of your investment portfolio makes sense.

House Hacking Tips for First-Time Buyers

The “Live in One, Rent the Rest” Starter Play

Shop 2–4 unit properties (duplex/triplex/fourplex). When you buy a multi-unit property and live in one unit, you get to enjoy owner-occupied financing rates. You can live in one of the units and rent the other(s) to help offset your mortgage payment. This could even allow for a lower down payment. It is important to calculate your potential monthly payment and assess rental rates in the area to figure out how having a renter(s) would help offset your monthly overhead. Also, consider if you had a vacancy, could you still make it work while you tried to fill it.

If the numbers work for your monthly cash flow, this is an excellent way to obtain homeownership. Down the road, you are building equity while someone else helps pay down your mortgage. Further, if you wanted to eventually move on to another property, you could sell this and reap the equity for a larger down payment or keep the property (at the owner-occupied financing rate) and rent all the units.

ADU Options

Seattle allows up to two ADUs per lot, and no owner-occupancy requirement (you don’t have to live there forever to keep it legal). Parking requirements are relaxed, too. Outside of Seattle these zoning requirements vary, but this is a rising trend.

You could buy a home with an existing ADU (detached cottage, basement unit, garage studio). Or buy an “ADU-ready”: daylight basement + exterior door, or garage with alley access. Start by renting a room or partial suite now, then add/finish an ADU later when cash allows.

Rent-by-the-Room to Offset Overhead

One roommate can take the edge off your payment; two roommates can be a full-on subsidy. When shopping for a home, prioritize layouts that naturally separate space (split-levels, basements, mother-in-law setups). We’ve seen some buyers already know who their roommate will be, so they can shop with confidence and also be comfortable with their living situation.

Purchase with a Trusted Partner with Similar Housing Goals.

Pooling funds for a down payment and sharing the monthly overhead is a great way to obtain homeownership with a trusted partner. This could be a close friend, family member, or domestic partner. You would ideally need to commit to at least 3-5 years of sharing the mortgage to build equity and avoid selling too early, and having a written agreement outlining the exit strategy is key. Based on average annual appreciation rates, 3-5 years would offset any selling costs and provide equity growth outside of something catastrophic happening in the market. This is a great way to protect your savings, build wealth as a team, and not throw money away on rent.

We knew two young women who pooled their savings to buy a home, and they also placed a roommate in a basement bedroom to help offset the mortgage. They later sold that house when they both got engaged and were able to buy great long-term homes with their partners using the equity they built. This partnered approach on their first home put them on the path to stability, security, and flexibility for their futures.

Buy a Cosmetic Fixer

Many buyers prefer homes that are “done” and fully updated. Those homes often come at a premium because they have a larger buyer audience. If you are willing to live with dated finishes or an unfinished space, you have the opportunity to build sweat equity with improvements you can make down the road when you can afford to.

It is important that you look for a home that’s structurally sound, as those can be expensive items to remedy, such as electrical, plumbing, roof, etc. Hiring a trusted inspector to perform proper due diligence is an important step. A dated kitchen or bathroom is a livable situation, and these homes build equity over time, too. If a home has an unfinished basement, there is an amazing opportunity to finish that space in the future and gain a higher value. Plus, you could rent this finished space to help offset the expense.

Buy a Fixer

There are renovation loans available, such as an FHA 203(k), that can be used to do more extensive repairs, additions, and updates. These loans provide funds to make improvements after closing. They are very detailed loan programs that require further scrutiny on value through appraisal and contractor bids, but can be successful in bringing a broken-down home to a livable structure and on the path to building equity. You have to be hearty and resourceful for these projects, so heed caution when considering this option. We have a great list of vendors and contractors that can help.

Most importantly, you must consider the Triangle of Buyer Clarity when shopping. Whether you are house hacking or just buying your first home without any of these creative solutions, being realistic about what you can afford is paramount. The relationship between location, price, and features/condition matters! Buyers must be flexible with their wants and understand that in reality, they typically get 70-75% of what’s on their wish list. Such as buying a townhome instead of a single-family home, settling on a location a little further away, or choosing a home that is not perfectly updated. However, they get a house and an opportunity to build wealth! This wealth-building game is a step-by-step process with every home a stepping stone over time.

As you can see, this triangle is not a perfectly balanced triangle, some sides are adjusted more than others. A buyer may have to reduce the number of features they would like in order to obtain the price and/or location they desire. This gets them on the path of equity growth, though, so compromise and flexibility are key! You need to get clear on your goals and adjust the triangle to make it work.

In our next newsletter, we will touch on house-hacking tips for multi-generational households. This can be helpful for first-time buyers as well as retirees who are on fixed incomes. This helps families stay together and avoid the high cost of assisted living. In the meantime, if you are curious about how these house hacking tips can help you or someone you know, or you’re just curious about the market, please reach out. It is always our goal to help keep you informed in order to empower strong decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link